Using a Cocktail Recipe to Play Chess January 2024 Investing Letter

Stocks start 2024 at the same level they started 2022. Does that mean Wall Street’s outlook for companies is unchanged? Perhaps it is odd to

Stocks start 2024 at the same level they started 2022. Does that mean Wall Street’s outlook for companies is unchanged? Perhaps it is odd to

Stocks gain 6% in November despite scary bond yields and 19% YTD in defiance of the “recession consensus.” Why has 2023 been so good for

Stocks Drop 5% from July Peak. Trip to China. Face-PLNT or Opportunity? Markets have been in valuation contraction mode since the July peak. Including the

Behind the Shiny Objects and Gloss, the View is Less Wonderful US markets have geared themselves to decelerating inflation, relatively stable economic figures and a fascination with

Most thought there would be a 2023 recession. Then stocks rebounded 30% from lows. In January I remarked on a unique event in the financial

The debt ceiling deal was the biggest non-surprise of 2023. So why did the market rally on its completion? The stock market (measured by the

This weekend we were shocked to read that more than 2,300 cans of Miller High Life were destroyed on the orders of French customs authorities.

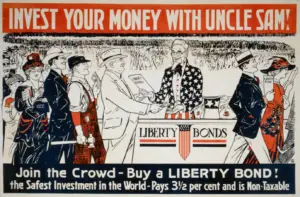

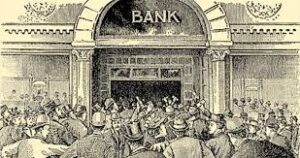

The Sixteenth Largest US Bank Failed Last Week Together with Yet Another Crypto-Linked institution. Markets sold off last week. Two factors were at work. First,

News reports claim that Canada and the U.S. have abandoned the search for downed floating objects. Apparently, the governments are comfortable that they may never have an

An article in today’s WSJ notes that nearly 2/3 of professional economists predict recession in 2023. This has basically never happened before.

Sign up for our Investing Newsletter

Our monthly letter, written for non-professional investors, outlines our latest thoughts on markets, and shares our investing philosophy.