$6.6 Trillion of Wealth Liberated in Two Days: Why I’m Not in the Ultra-Bear Camp

In my March letter I wrote that I wasn’t yet worried. Am I worried now? Let me explain. By now you’ve already read more than

In my March letter I wrote that I wasn’t yet worried. Am I worried now? Let me explain. By now you’ve already read more than

February was a cold, dark and thankless month for the markets. After rising nearly 3% to start the year in January on top of a very

Biden passes the torch to Trump today and a tenuous cease-fire agreement starts in the Middle East. I think everyone can agree that less fighting

The market’s reaction to the election has been overwhelmingly positive. This is not surprising. The market normally rises following a presidential election due to the

I can think of few topics more over-discussed in the financial media than what the Federal Reserve is doing and what it is saying about

A few things. First, the momentum trade in artificial intelligence (AI) stocks has reversed, at least temporarily. This could be a simple technical pull-back but it may

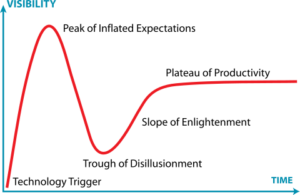

The previous market narrative has been hit by a shot of turbulence. The focus on the AI revolution and the stable economy was so entrenched that it literally

Markets are navigating in the slack water between economic narratives. In 2021 stocks rose on the post-Covid reopening and stimulus. In 2022, stocks dove on

April was a more difficult month for the markets. What happened? The inflation data wasn’t as wonderful as some people were hoping, which pushed out

That Irritating Noise Being Ignored is Sound of Favorite Consumer Companies Signaling Distress The market is focused on tech, but consumer spending is still

Sign up for our Investing Newsletter

Our monthly letter, written for non-professional investors, outlines our latest thoughts on markets, and shares our investing philosophy.