The previous market narrative has been hit by a shot of turbulence. The focus on the AI revolution and the stable economy was so entrenched that it literally required a hail of bullets to alter the conversation. The markets had mostly been ignoring the upcoming election. Now with Wall Street thinking it knows who mostly likely will win, it has become top-of-mind for portfolio managers. In a knee-jerk reaction, big tech has taken a hit, as have companies that rely on imports, including many retailers. Crypto went up. Should you jump on these trades or try to anticipate future policies and their impact on specific equities?

Let’s invert the question

Rather than scramble to position for a hypothetical future, I believe investors should ask themselves what won’t change regardless of who becomes the next occupant of the White House. Looking backward, the reaction to the Presidential debate, which set in motion this shift in focus, may have been foreseeable. However, the repercussions the assassination attempt must clearly fall into the category of a wholly unpredictable occurrence. Nevertheless, instead of taking a lesson from this regarding our inability to anticipate important market-driving events, investors have simply pivoted to focusing what we now know about the outcome of the next U.S. election. And the action has been to sell some stocks and buy others. But does it really make sense to do this with the election months away and the next administration not starting before early 2025? Why would professional money managers change their investments with so much potential for things to develop unexpectedly between now and then? It’s because most are incentivized on annual performance and the election falls very close to year-end. Fortunately, you don’t have to follow this crowd.

The changing fortunes of retailer Five Below (FIVE) provides an illustrative analogy

I have followed FIVE closely since its 2012 IPO. If you aren’t familiar with this company, what you need to know is that FIVE operates about 1,600 stores selling products mostly for $5 or less with a teen or college-age customer in mind. It is also known for finding the latest “trending” items which recently have been Squishmallows and slime-making kits but in the past included hits like fidget spinners and gummy bracelets. FIVE also sells plenty of other categories that have a more durable demand and broad appeal including electronics, arts & crafts, school supplies, home decor, cosmetics, drinks and candy. If that sounds like an unlikely winner note that earlier this year the shares were going for over $200 and the stock had compounded at an annual rate of 18% in the twelve years since going public.

Analysts love a winner. At the start of the year, 80% of professional analysts with published opinions rated the stock a “buy” and happily recommended it to clients. The relatively high price to earnings (P/E) multiple of 33x forward earnings was safely ignored. Perhaps you anticipate where I am going with this. Fast forward five months. FIVE shares are now changing hands for less than $80, an astonishing loss of more than 60%. The P/E is less than 15x, but instead of loving it at the better price, 60% of the analysts now say to avoid this stock.

What happened? The company reported bad results. But the point of this story is that at $200 per share investors were fooling themselves about the visibility they believed they had into the company’s future performance. Now, at $80, the market is so apprehensive about FIVE’s future that few want to buy it. My thinking about the situation is different. In my view, the range of possible outcomes for FIVE several years from now is entirely unchanged compared to what it was five months ago. What has changed is the perceived uncertainty.

Selection from our client portfolio: Match.com (MTCH)

One thing I am pretty confident about is that in the future, people will still want to meet other people. There can be changes in societal trends around marriage and children, but there is an evolutionary impulse to meet others. This is where Match.com comes in. MTCH is by far the largest operator of dating websites and apps with Tinder, Hinge, PlentyofFish and a host of other sites operated by the company.

I also like that MTCH has a very clear, easy-to-understand business model. It operates websites and dating apps, and its customers pay a fee for membership and access to the profiles of others on the system. There is a clear scale advantage and network effect here as users benefit from flocking to the same sites and apps. This in turn creates a barrier to entry for would-be competing dating apps.

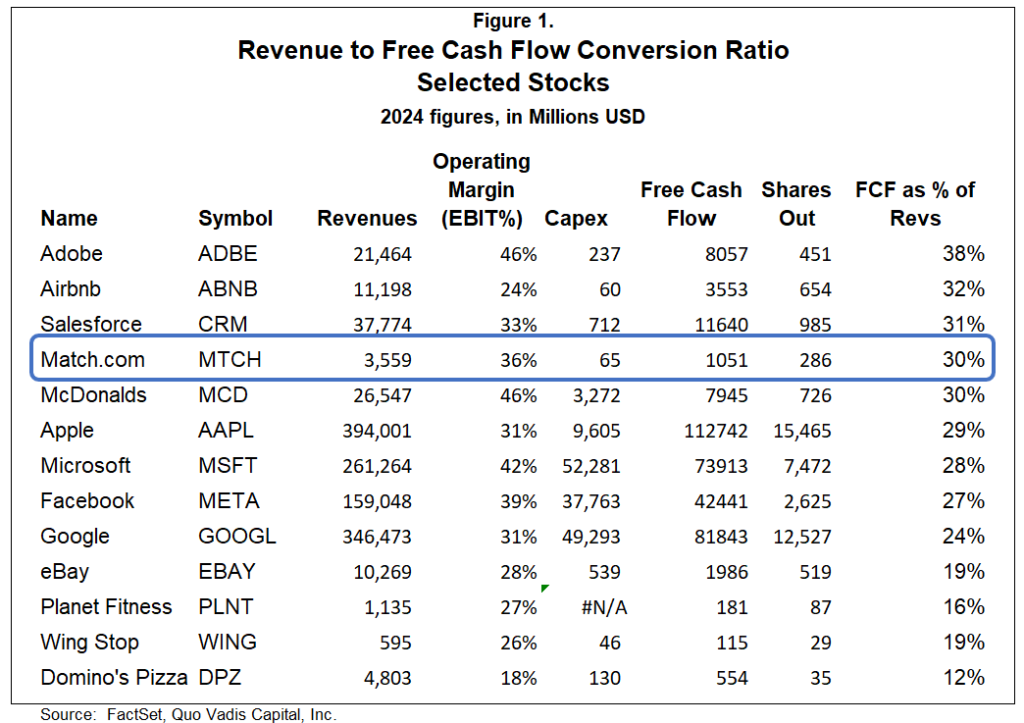

The company is exceptional from a financial perspective. It has operating (EBIT) margins of 36%, and free cash flow as a percentage of revenues (one of my favorite metrics) is 30%. Put differently, $0.30 of every dollar of revenue is left over to be distributed to shareholders. See Figure 1 for a selection of public companies ranked by this measure.

Lastly, the stock is cheap. We estimate that over ten years, MTCH will produce free cash flow exceeding the company’s current enterprise value. In other words, for the price you’re paying today, you can potentially get back the entire value of the company in excess cash flows in less than 10 years, and still own the asset. In the past, this has proven to be a good signal that a stock is undervalued. In the future, another thing that won’t change is that buying with a margin of safety improves the probability of a favorable investment outcome.

*This is not a recommendation. Please consult your advisor for investment advice tailored to your risk tolerance and investment profile.

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

John.zolidis@quovadiscapital.com

Mr. Zolidis has 25 years’ experience as an equity analyst. In 2017 he founded Quo Vadis Capital, Inc., a Registered Investment Advisor (RIA) offering investment management for individuals and an idea service for professional investors. He is a frequent presenter at value investing conferences around the world and a guest lecturer at Columbia Business School. Prior to founding Quo Vadis, Mr. Zolidis was a sell-side analyst following the consumer sector. He also managed money in a buy-side role at a long-short equity fund over 2013-2014. He was named in the Wall Street Journal’s Best on the Street list in 2005. He started his career in finance in 1996 following degree studies in Philosophy at Kenyon College and the University of Oxford. Mr. Zolidis and works from New York, NY and Paris, France or wherever he has his laptop.

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is a Registered Investment Advisor (RIA) in the State of New York. THIS IS NOT AN ADVERTISEMENT. This is not a solicitation. Please consult your financial advisor for advice tailored to your financial and risk profile.

The author of this letter and accounts managed by Quo Vadis Capital have a long position in shares of MTCH.

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.