Markets are navigating in the slack water between economic narratives. In 2021 stocks rose on the post-Covid reopening and stimulus. In 2022, stocks dove on inflation and concerns the Fed would tighten (raise interest rates) too much. In October 2023, the macro narrative pivoted to hoping for interest rate cuts. Fast forward and here we are in mid-2024 and neither has the economy gone into recession nor is anyone still expecting a series of interest rate cuts. In this temporary absence of a consensus economic undercurrent, I am seeing stocks moving primarily on individual fundamental merits. It’s kind of refreshing. It won’t last.

Lack of top-down narrative does not mean directionless. Artificial intelligence (AI) is proving to be THE investment theme of 2024.

Is it too late to invest in this idea? It’s not too late. Consider that most or all of the benefits of the AI revolution are still in front of us. That said, there is a distinction between investable theme and investment hype. Hype is when stocks move on headlines, egged on by the media, with the gains out of proportion to fundamentals. Let me give you an example that is open to debate.

Last week, Apple (AAPL) held its 2024 development conference. Investors liked what they heard and AAPL shares rose $20 per share over two days, adding more than $300 billion to the company’s market value. (That’s roughly the annual GDP of a medium-to-small size country like the Czech Republic, Chile or Romania, in case that abstract comparison means something to you.) Anyway, what did AAPL announce? It is integrating AI into its ecosystem with functionality upgrades for Siri and across its many apps, among other things. Tim Cook said it’ll be “beyond artificial intelligence” and into “personal intelligence”. Apple is an amazing company, and I am confident that AI tools will make its products and services better. However, quantifying the impact in terms of revenues and earnings is impossible. As best as I can tell, analysts didn’t even touch their forecasts. Thus the $300 billion increase in AAPL’s market cap is based on what? Favorable theme or hype? You tell me.

A friend of mine who’s closer to this situation than I am suggested the jump in AAPL shares was not about the AI push per se but was instead explained by relief that the company isn’t pursuing the capital-intensive spending seen at Microsoft (MSFT), Facebook (META), and others. Recall that META shares dove over $50 per share, erasing $130 billion of market value, when it announced its recent earnings and investment spending on AI. I wrote about this last month. Perhaps. Either way you look at it, the stock added $300 billion in value based on the content of a press conference.

Returning to my point, the confused macro situation and the promise of exciting new technology have led the market to focus on AI and assign big increases in value to many of the companies involved. I am not and will never be an expert in AI, but I believe it makes sense to own some of these companies. After all, read what Bill Gates had to say about it in a post. (Emphasis is mine.)

“The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone. It will change the way people work, learn, travel, get health care, and communicate with each other. Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it.”

Bill Gates is a lot smarter than me, and I am sure he is going to be right about AI. However, from an investment perspective, even if we fully buy in to the promise of AI, it does not justify owning every name, chasing every headline, or getting involved after every fancy power point presentation.

Why I bought shares of Salesforce (CRM) for my clients.*

I look for high margin, cash generating companies that can grow and then try to buy their shares opportunistically at a discount. Put differently, I want to invest in excellent businesses when the current stock price does not already fully reflect the expectations for foreseeable growth. If a company is recognized as a great business, there are often only two situations where you’ll get a chance to buy its stock at an (unusually) attractive price. The first is if the whole market tanks. These are wonderful buying opportunities but occur infrequently at unpredictable intervals. For several reasons, sitting on cash and waiting for market panics is not a workable strategy for most. The second situation when you might get to scoop up shares of a wonderful company at an especially attractive price is if there is a crisis or event that causes existing holders question the growth story. This becomes a judgement exercise, requiring investors to weigh the lower stock price against increased uncertainty. With this in mind, we recently purchased shares in Salesforce (CRM) the largest provider of enterprise software for customer relationship management (the source of the ‘CRM’ of the stock symbol). The company, which has been a component of the Dow Jones Industrial Average since 2020, is well known so I’m not going to delve into a long discussion of the business. Rather, I’ll just note that CRM boasts a 33% operating (EBIT) margin (which is very high) and generates robust free cash flow (FCF), with FCF equivalent to over 30% of revenues. (FCF as a percentage of revenues is one of my favorite metrics.) The bottom line is that CRM has a very powerful financial model.

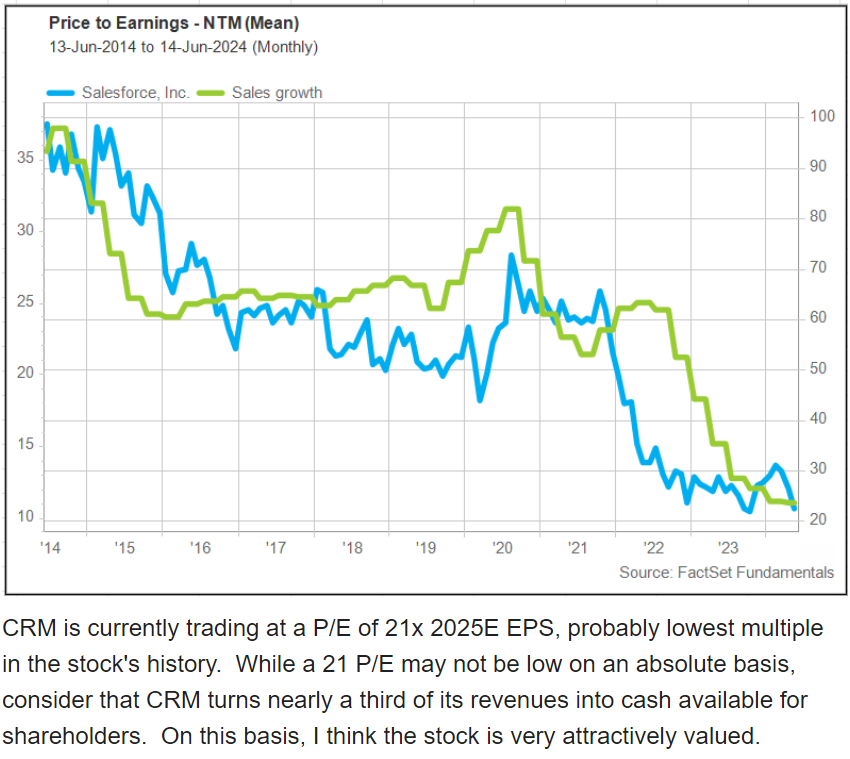

The stock is also trading at the lowest valuations in the last 10 years, perhaps ever. There is a reason. Growth is slowing. In mid-May the company reported results including a slower-than-expected forecast for future revenues. This sent the stock down 20%, which provided our entry point. The chart below shows CRM’s revenue growth rate (the green line) against the stock’s price to earnings multiple (the blue line). It’s obvious that these two items are tightly correlated. Without attempting to diagnose the reasons for the slower-than-expected growth, let me say that I consider an investment in the company here to be a calculated wager that CRM can grow again in the future at faster levels. Meanwhile, I have the protection of buying at the lowest valuation in the company’s history and the business’ robust profitability and cash flows.

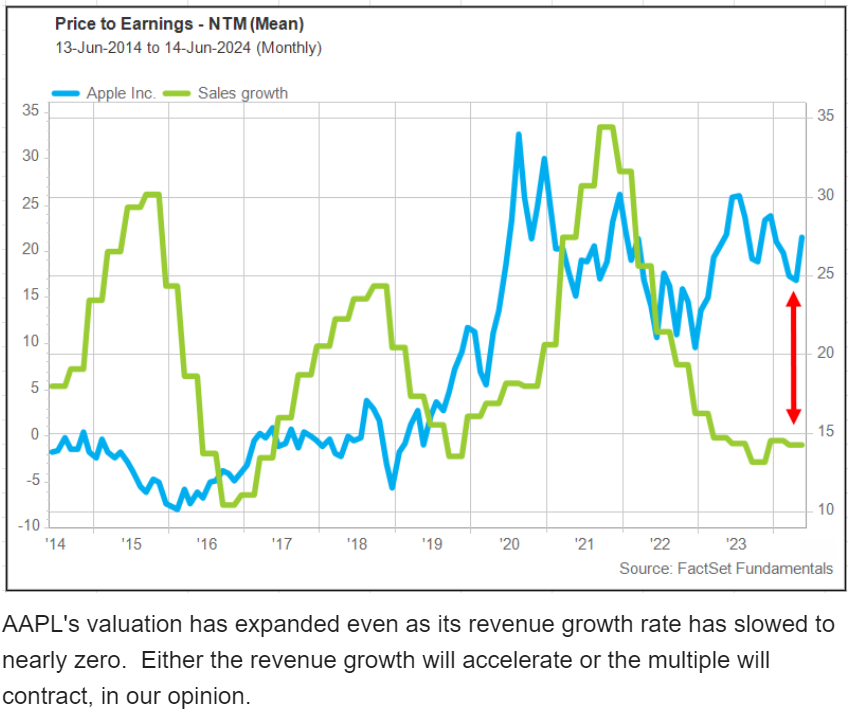

The same chart with Apple (AAPL) provides an interesting contrast. I recently sold out of AAPL shares (discussed here) due to the disconnect I saw between mediocre growth (revenues are growing <2%) and the stock’s performance and valuation. The latest move in the stock has exacerbated this situation, making the stock even less attractive, in my opinion. One charitable way to look at AAPL is to hypothesize that investors are pricing in a reacceleration in growth. Again, this contrasts with CRM, where the stock’s multiple reflects fear of further deceleration. Which stock will perform better from here? Time will tell.

Recent Activities and Upcoming Travel

In June I am flying to Colorado and passing through Denver en route to Vail. The main purpose of my trip is to attend the ValueX Vail investment conference, where I will present an investment idea on a retail stock. If you’d like to receive a copy of the deck after I present it, please send me a message. (Last year, I gave a talk on how mental models get in the way of making good investment decisions and you can watch a condensed and edited version here.) I am very grateful to attend this conference, which brings together investment managers from across the country and abroad to discuss investing with a value-approach in a beautiful setting. I won’t hide that I may be arriving early to get in some fly fishing on the Eagle River. I am also planning to take advantage of a break in the schedule to get some downhill MTB on Vail Mountain. It’s going to be epic.

*This is not a recommendation. Please consult your advisor for investment advice tailored to your risk tolerance and investment profile.

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

John.zolidis@quovadiscapital.com

Mr. Zolidis has 25 years’ experience as an equity analyst. In 2017 he founded Quo Vadis Capital, Inc., a Registered Investment Advisor (RIA) offering investment management for individuals and an idea service for professional investors. He is a frequent presenter at value investing conferences around the world and a guest lecturer at Columbia Business School. Prior to founding Quo Vadis, Mr. Zolidis was a sell-side analyst following the consumer sector. He also managed money in a buy-side role at a long-short equity fund over 2013-2014. He was named in the Wall Street Journal’s Best on the Street list in 2005. He started his career in finance in 1996 following degree studies in Philosophy at Kenyon College and the University of Oxford. Mr. Zolidis and works from New York, NY and Paris, France or wherever he has his laptop.

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is a Registered Investment Advisor (RIA) in the State of New York. THIS IS NOT AN ADVERTISEMENT. Please consult your financial advisor for advice tailored to your financial and risk profile.

The author of this letter and accounts managed by Quo Vadis Capital have a long position in shares of META, CRM, MSFT.

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.