April was a more difficult month for the markets. What happened? The inflation data wasn’t as wonderful as some people were hoping, which pushed out expectations for interest rate cuts. Stocks were also due for a pull-back. Our view hasn’t changed. We believe economic conditions are generally good, driven by near-full employment and the investment cycle in tech which we’ll discuss more below, among other factors.

According to Peter Lynch, the Correlation Between Stock Prices and Earnings is 100%

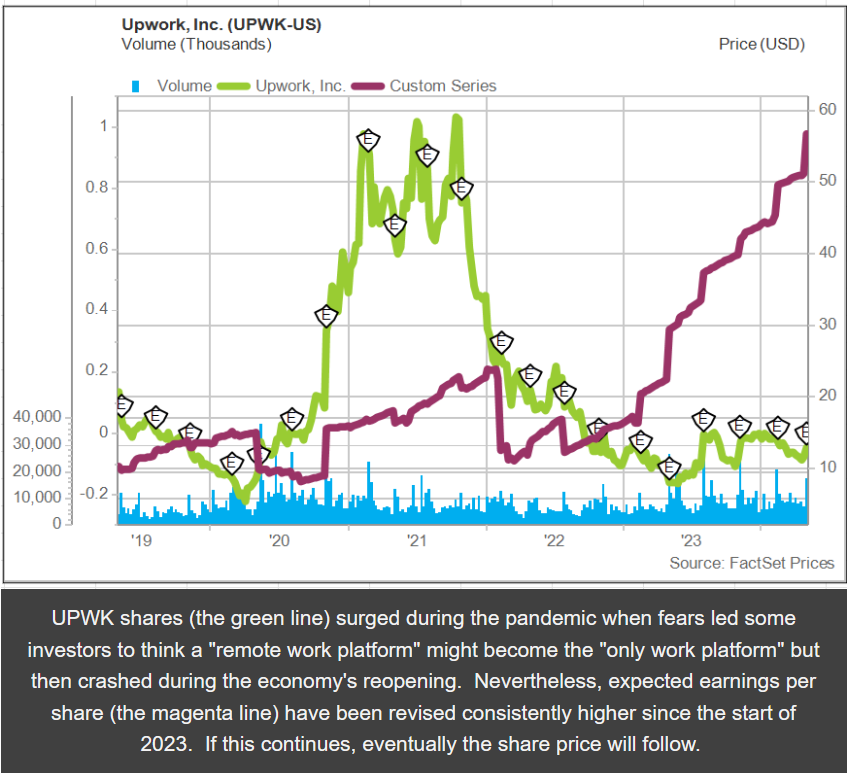

While the famous Fidelity fund manager was emphasizing to make a point, when measured over shorter periods, stock prices often move in the opposite direction of earnings. It’s up to investors to determine whether this represents opportunity or something else. Let’s take Upwork (UPWK)*, a stock we own, as an example. Upwork is an online platform to connect skilled workers to temporary assignments. It is a simple business model that makes money by charging a commission on revenues for services booked on its site. Gross margins are north of 80%. I like to think of it as the Airbnb (ABNB) of work. We have owned the stock for several years and it has been a loser. However, the reason we’ve stuck with it is that it continues to grow, which we like, and it has the potential to be much more profitable in the future than it is today, which we like even more. Further, UPWK’s profit outlook has been revised favorably for the last six consecutive quarters. (See chart below.) Despite that, shares have languished, with the implication that the stock has become progressively cheaper. It is now trading with a P/E of just over 13x vs. 2025 estimates which strikes me as quite low for a company that management believes can one day produce a 35% EBITDA margin (profits before interest, taxes, and depreciation).

This is not going to last. Either higher earnings will eventually pull the share price up, per Mr. Lynch’s claim, or the business, which has only a $1.7B market cap, will be acquired. Who would buy it? I personally think it would be an excellent fit with LinkedIn. (Microsoft (MSFT) bought LinkedIn in 2016, paying $26B or nearly 7x estimated revenues for social networking site.) LinkedIn already knows who is hiring and it has an enormous database of workers who have provided their qualifications in great detail. Plugging a remote work revenue-sharing platform into LinkedIn’s vast system would seem to be incredibly synergistic for all parties involved, notably LinkedIn users.

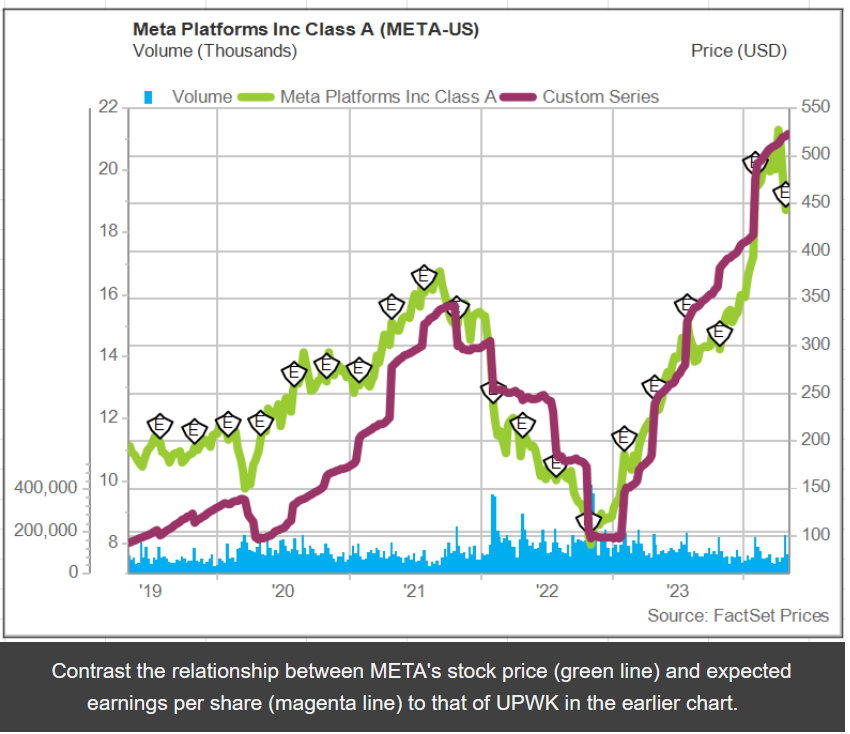

The second name to talk about is Facebook (META)* which will inform a broader point about capital investment. Following its recent first quarter earnings, META shares were pummeled. Why? The company disclosed incremental billions of spending dollars to develop artificial intelligence (AI) tools. And so what? Well, investors are still smarting from META’s 2022 performance and the tens of billions in cumulative losses so-far spent on the ghost-town known as the metaverse. Perhaps AI is lining up as a second black hole for META’s cash? I am not worried for two reasons. First, the value in META is its relationship with over three billion users. The user base amazingly continues to grow, and the long-term value of these users is so outrageously large that quantifying it boggles the mind. My mind, anyway. Secondly, META’s job is to keep these users engaged while developing tools to monetize their content and the hours they spend on Insta, Facebook, WhatsApp, Threads and whatever they come up with next. I see spending on both the metaverse and investments in AI as efforts in this regard. As a shareholder, we should want the company to invest in additional capabilities and enhancements. Maybe some will fail. But just imagine the potential supernova when applied to a 3 billion-plus user base.

The broader point is on AI investments in general. According to estimates from my friends at 10,000 Days Capital management run by Cody Willard, capital spending from the six largest tech companies (excluding Nvidia) on AI this year will be >$200B. This does not include all the salaries for AI-related workers. I am not sure the right way to contextualize all the dollars going into and being spun out of these efforts, not to mention the wealth-effect of the increase in market capitalization of large technology firms, but it seems like it must be material at least to GPD growth. We want companies to invest in these capabilities. It’s good for general prosperity and that’s before AI accomplishes something more relevant than a chatbot that can answer obscure questions and write sneaky papers for undergrads.

Recent Activities & Upcoming Travel

In May I am spending about two weeks in Southampton NY and NYC with my daughter, who will soon be a rising senior at Tulane University. She is tasked with getting her driver’s license. I will enjoy my own personal chauffeur. If you’re going to be out that way let me know.

Earlier this month, I was a guest on CNBC Asia to discuss restaurant company results. My buddy managed to scrape their video and we rejiggered it into a two-minute “short” which I’ve uploaded to my YouTube channel. You can check it out here but be kind as it was filed at 4:45 am. Thanks for “liking” it!

*This is not a recommendation. Please consult your advisor for investment advice tailored to your risk tolerance and investment profile.

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

John.zolidis@quovadiscapital.com

Mr. Zolidis has 25 years’ experience as an equity analyst. In 2017 he founded Quo Vadis Capital, Inc., a Registered Investment Advisor (RIA) offering investment management for individuals and an idea service for professional investors. He is a frequent presenter at value investing conferences around the world and a guest lecturer at Columbia Business School. Prior to founding Quo Vadis, Mr. Zolidis was a sell-side analyst following the consumer sector. He also managed money in a buy-side role at a long-short equity fund over 2013-2014. He was named in the Wall Street Journal’s Best on the Street list in 2005. He started his career in finance in 1996 following degree studies in Philosophy at Kenyon College and the University of Oxford. Mr. Zolidis and works from New York, NY and Paris, France or wherever he has his laptop.

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is a Registered Investment Advisor (RIA) in the State of New York. THIS IS NOT AN ADVERTISEMENT. Please consult your financial advisor for advice tailored to your financial and risk profile.

The author of this letter and accounts managed by Quo Vadis Capital have a long position in shares of META, UPWK, MSFT, ABNB.

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.