| The S&P has gained 4% YTD and we’re in a full-on bull market, still led by the big tech stocks. Stock prices were recently near the same levels as two years ago but earnings forecasts are higher now. Economic activity appears solid based on recent company results. The direction of inflation and interest rates both look favorable. And the market already had positive momentum heading into the year. Taking all this into consideration, it’s not that surprising that 2024 has started off well. It also suggests that the path of least resistance remains upward, at least until something develops to interrupt the narrative of economic growth amid falling interest rates. What we are doing with two widely held stocks in our client portfolios We run a concentrated book and try to trade as little as possible. My approach is to look for high quality names that can deploy capital back into their existing businesses to grow over the long-term. I then try to be patient and buy these companies opportunistically when prices are attractive. (Easier said than done.) What about selling? I sell under one of three conditions: 1) the long-term growth narrative is broken, 2) the price is ridiculous, or 3) something better has come along. Note that I did not list “take profits” as a reason to sell. While the Wall Street adage is that “no one goes broke taking profits” the main beneficiaries of selling frequently are the tax man and your broker’s commissions. In contrast, I suggest a much better outcome would be to delay realizing gains indefinitely. Let’s look at two widely held names that we have owned for over five years in client portfolios and the opposite conclusion we reached with each: |

Meta Platforms (META) aka Facebook

I am comfortable with META (Facebook) as our largest position even after a huge move. META vaulted 20% on Friday to north of $485 and is up 35% YTD. It is up 155% over the past 12 months. The monster gains have more than reversed the absolute shellacking the stock took in 2022, when it fell to below $100 from a peak above $385. We’ve had an oversized position throughout the whole wonderful ride.

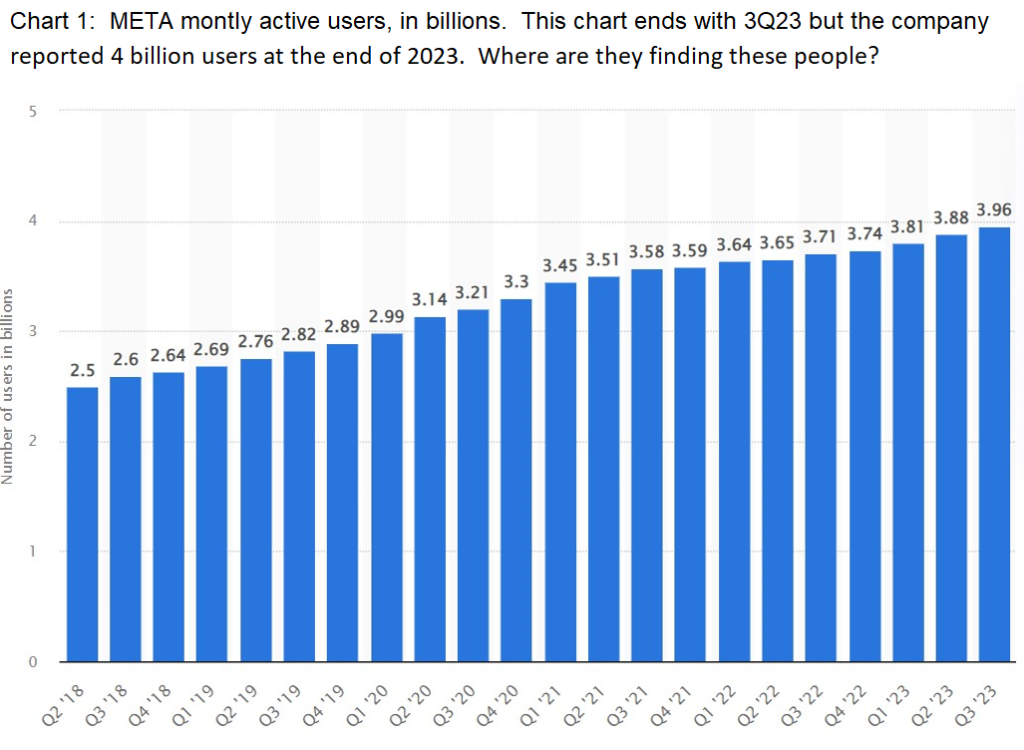

I’m not selling near $500 and I didn’t sell any near $100. I didn’t sell any at $385 in 2021. The reason for not selling is unchanged. It’s our investment thesis: The long-term potential to monetize META’s four billion monthly active users is truly enormous AND the company is only in the very early days of profiting from its user base. Think about the lifetime value of these customer relationships. Also, think about how hard Facebook has tried to screw it up. Think about how much the media likes to heap shame on the business and management. How many times has poor Zuck been called to Congress to explain to lawmakers that Facebook makes money “by selling ads”? If the business can survive all that plus billions in losses to build in a fantasy-verse that will remain forever empty, surely this is one of the most anti-fragile companies ever created.

Also worth noting, when we started buying META shares (then going under the FB symbol) the monthly active user base was “only” 2.5 billion. I had no expectations it would grow. Here we sit today at 4 billion. The limit has not been reached. The value of META’s customer relationships continues to increase. See chart below for growth in users.

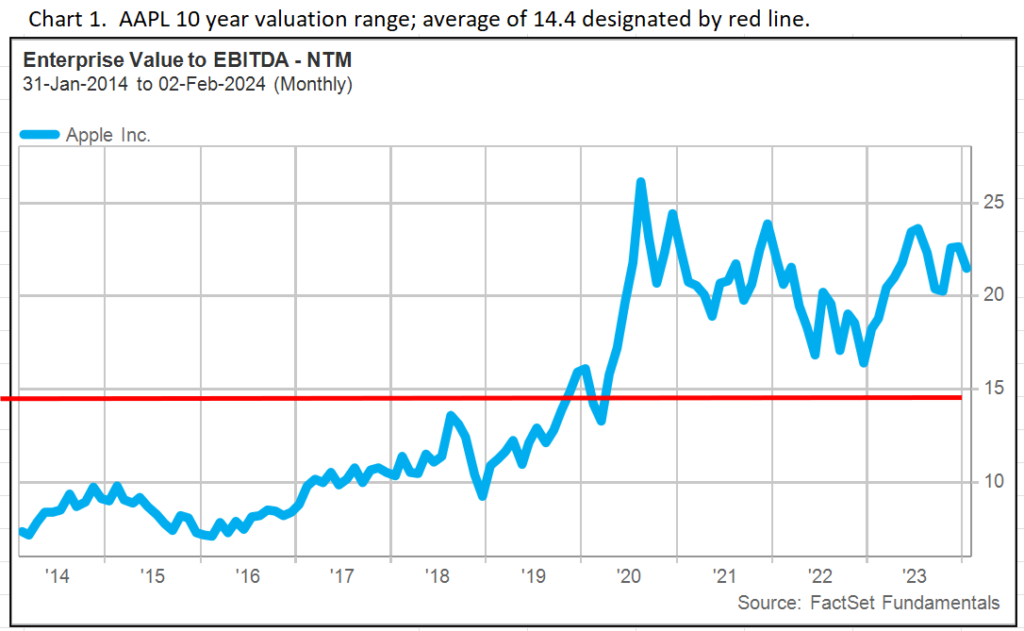

What about valuation? I think META is downright cheap. It currently trades at 13x 2024 EBITDA. Apple (AAPL) which we’ll discuss below, is at 21x. META’s revenue growth this year is expected to be 17% and EPS growth is estimated at 30%. APPL is supposed to grow revenues 2% this year. Anything could happen and perhaps I’ll regret writing this but selling META here “because it went up” is not a good idea. I’m sticking around.

Apple, Inc. (AAPL)

We sold AAPL. Apple is a wonderful, indispensable company. It is an American Icon. It will continue to innovate and create value and produce enormous amounts of cash for decades to come. It sounds dumb to sell AAPL. Maybe it is. However, after previously trimming positions in Quo Vadis portfolios in August 2023, which I wrote about at the time, I have decided to exit the stock altogether. The simple reason is a mismatch between the rate of growth and the valuation. AAPL is not growing much. It forecasted flat revenue growth in the first quarter of this year. Analysts expect only 2% revenue growth for the year. Revenues were down in 2023. The stock, in contrast, has advanced and now trades at a significant premium valuation compared to the past. Five years ago, AAPL traded at 11x EV/ EBITDA. Today it is at 21x. On a P/E basis, shares trade at 28x. The 10-year average P/E is 19x. See a valuation chart below. These higher multiples could make sense, but only if AAPL is about to deliver innovation to reaccelerate the growth rate (say an Apple self-driving car, for example). Is that going to happen? Maybe. When? Probably not soon. The stock should correct, in my opinion. If that occurs, perhaps I will buy it back, but not if revenue growth is mired in the 2%-4% range. The growth narrative has been broken. At least for the near-term. I believe I can find better than that.

Recent activities

I just got back from ValueX Klosters conference in Klosters, Switzerland (two hours from Zurich by train). As expected, the conference was a great time and an opportunity to meet professional and private investors from dozens of countries with diverse viewpoints and approaches. Thank you to Guy Spier and the Aquamarine team for putting together the event. I enjoyed giving a presentation on Dollar Tree (DLTR) to finish up the first day. Please message me if you’d like a copy of the slides from my talk.

February looks relatively calm from a travel perspective. In early March I will be heading back to the U.S. with an itinerary still to be determined but it will include New York City and Southampton, NY. If you’ll be in either place and would like to meet up, I’d love to see you. Thanks!

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is an independent research provider offering research and consulting services. The research products are for institutional investors only. THIS IS NOT AN ADVERTISEMENT. Please consult your financial advisor for advice tailored to your financial and risk profile.

The author of this letter and accounts managed by Quo Vadis Capital have a long position in shares of GOOGL, META.

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.