Stocks gain 6% in November despite scary bond yields and 19% YTD in defiance of the “recession consensus.”

Why has 2023 been so good for stocks? The year started with a lot of pessimism. Stocks lost more than 19% of their value in 2022. Coming into 2023, the narrative was that the consumer (2/3 of U.S. economic activity) would buckle under the combination of higher prices for goods and services (inflation), higher interest rates, and less support from government “freebies”. Most Wall Street economists, who are normally paid to publish cheery outlooks, instead forecasted a recession.

The consumer has dialed back some spending. And recent reports from companies suggest that spending power continues to deteriorate. Retailers are seeing “trade-down” which occurs when customers swap a lower-priced private label for a higher-priced national brand. We’re also seeing consumers spend less on discretionary categories like apparel and home goods. Customer trips to deep discounters are up. High-end department stores and restaurant operators are reporting fewer customer visits vs. last year.

But by in large, it hasn’t been that bad. The consumer and the economy have not collapsed. A very strong job market has been the difference-maker. Past interest rate hiking cycles may have all preceded recessions and the yield curve may be hyper-inverted, but so far, at least, these signals have not proven prescient.

Theme reversal at year-end

November was a very good month for stocks. There are two factors that I would highlight. First, the inflation figures continue to improve. Price increases are diminishing. Second, retailer results and commentary around the start of the Holiday season were soft, but not terrible. Ironically, the improved inflation figures, combined with more evidence of a weaker consumer, flipped interest expectations for next year. The market is now expecting that interest rate cuts will be needed. What stocks benefit from rate cuts? The beaten-down consumer names (such as retailers of discretionary goods like Target) that most investors have been avoiding.

Goldilocks in 2024, or something else?

The market is often very thematic. People tend to think in stories, and investors are no different. 2023’s themes have included peeling back the interest-rate-inflation-recession narrative, the resilience of the U.S. in an uncertain geopolitical environment, and the rise of AI.

No professional investor with whom I speak thinks that the consumer will be stronger in 2024. The lagged effects of higher interest rates have not been fully felt. The resumption of student loan payments, which is taking $6 billion per month out of spending, has only just started. Many retailers and consumer companies are already talking down 2024 estimates and planning for reduced demand. Investors are wary of China but few are considering Ukraine-Russia or the Middle East conflict as major risks.

I think the dominant approach right now is to make it to year-end, and hope cracks in the housing sector and a more constrained consumer don’t turn into major fissures. For my part, I don’t have any special ability to forecast the economy or what the market might do in 2024. Instead, I have an investment approach that acknowledges and accepts uncertainty. I’m looking for company-specific stories, whether cyclical or otherwise, that have attractive long-term growth opportunities and can be bought at a discount. A name we recently bought for clients that is in this spirit is Align Technologies (ALGN).

Selection From our Investment Portfolio: Align Technologies (ALGN)**

ALGN is the maker of the Invisalign teeth-straightening system. The company’s products are mostly sold to dentists and orthodontists who in turn get patients to pay for them. The company’s Invisalign aligners are simply better than the alternative, metal braces and rubber bands in your month. The company has grown by taking share from traditional metal braces, getting customers outside the tender teenage years to sign up, and by entering new markets. This has added up to impressive growth, with revenues increasing at a combined annual growth rate (CAGR) of 23% in the ten years leading up to the Covid-panic (which happened in 2020, in case you forgot). Operating profit over the same ten years grew even faster, at a 30% CAGR. Operating profit (EBIT) margins were above 22% for the six years prior to 2020. But even more impressive was ALGN’s ability to convert revenues and operating profit to free cash flow. In the five years prior to Covid, ALGN generated $2.88 billion in free cash flow, equivalent to 20% of the company’s revenues over the same period. Few companies, and even fewer growth companies, convert revenues to free cash flow at this rate. The business is a behemoth.

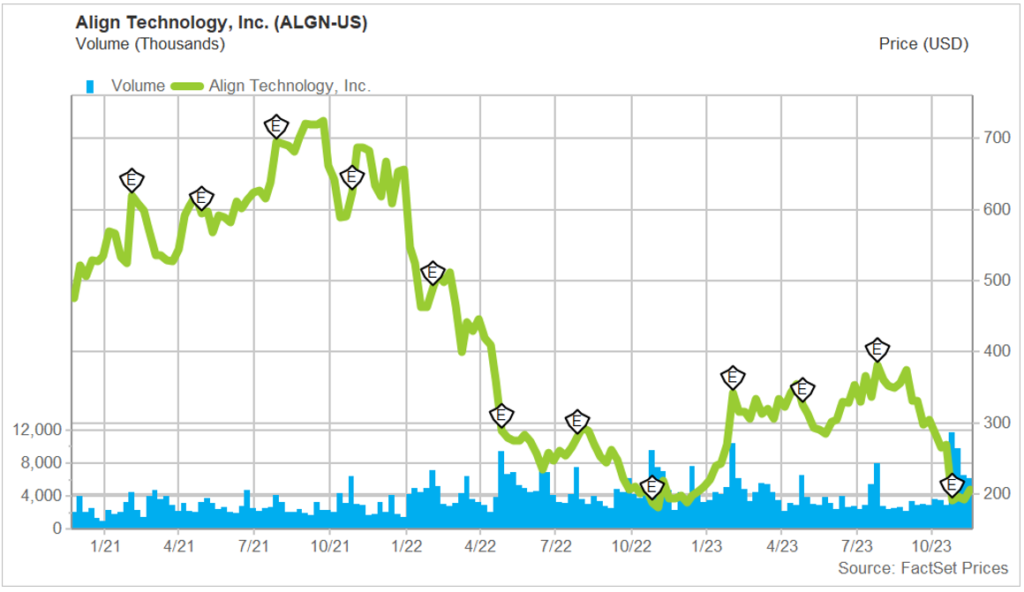

Then Covid happened. People wore masks. And they got free money in the mail. What’s a great thing to do when you are wearing a mask and money is free? Get your teeth fixed. Sales of Invisalign exploded, rising 60% in 2021. Shares of ALGN followed suit. The stock raced from a pre-Covid $300 per share level to over $700 by October 2021. Along the way the stock got a valuation as high as 47x EV to EBITDA, which made it among the most expensive names in the entire market.

Fast forward to 2023. The Covid bloom is off the rose. Demand pull-forward satisfied many of the non-teenage customers needing teeth straightening. Free money no longer comes in the mail. Incremental competition is taking away some customers, primarily in China. The result is some give-back in revenues for the company, disappointing the momentum crowd, who torched the stock in their urgency to get out. ALGN shares recently sold below $200 (the stock closed Friday at $219). Valuation has collapsed and is now a much more reasonable 15x EV/ EBITDA (the P/E is 23x). Even here, I acknowledge that ALGN shares are not “cheap.” Further, the growth rate going forward will not be as robust as was in the past. Considering, on the other hand, the quality of the business (margins, free cash flow) and many markets remaining to be developed, while new sets awkward teenage teeth are appearing every day, I view this as a rare opportunity to invest in a powerful financial model at a very attractive price.

**This is not a recommendation to buy or sell any security. Please consult with your investment advisor for advice tailored to your investment objectives and risk tolerance.

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

John.zolidis@quovadiscapital.com

Mr. Zolidis founded Quo Vadis Capital, Inc., a Registered Investment Advisor (RIA) and research consultancy, in 2017. He started his career in finance in 1996 following degree studies in Philosophy at Kenyon College and the University of Oxford. He has followed U.S. consumer companies as a senior analyst since 1999, mostly on the sell-side, writing research for institutional investor clients. He also managed money in a buy-side role at a long-short equity fund over 2013-2014. He was named in the Wall Street Journal’s Best on the Street list in 2005. Mr. Zolidis and works from New York, NY and Paris, France or wherever he has his laptop.

Whereabouts and other activities: In late October and early November I traveled to the U.S., visiting San Francisco, Minneapolis, Green Bay (there was a very important meeting on Sunday at Lambeau Field), and New York. I met with clients, friends, visited retail stores, tried out some new restaurant concepts, and met with management teams of public companies. While in New York, I attended a Starbucks analyst meeting. One highlight was a guest lecture I gave at a Securities Analysis course at Columbia Business School. My talk was focused on what it takes to find a great investment idea. You can watch a condensed version (9 minutes) of my Columbia guest lecture on my YouTube channel via this link.

In December, I am debating another trip to New York to attend an analyst meeting among other activities. If you’re in the city and would like to meet up, please message me.

Shot taken during the start of the very important meeting:

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is an independent research provider offering research and consulting services. The research products are for institutional investors only. THIS IS NOT AN ADVERTISEMENT. Please consult your financial advisor for advice tailored to your financial and risk profile.

The author of this letter and accounts managed by Quo Vadis Capital have a long position in shares of Align Technologies (ALGN).

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.