Stocks Drop 5% from July Peak. Trip to China. Face-PLNT or Opportunity?

Markets have been in valuation contraction mode since the July peak. Including the bounce over the past three days, the price-to-earnings ratio (P/E) on the S&P500 has slid about 7% while the NASDAQ valuation has contracted 13%. This puts both near their respective 10-year average multiples to earnings. The stock moves have gone in the opposite direction of expected earnings, as forecasts have moved higher over the same timeframe.

Over time stock prices should follow earnings. In the short-term, the prices can be whipped around by about anything you can imagine. When prices are observed moving in the opposite direction of earnings forecasts, like we’ve seen since July, it’s worth trying to understand the move. Sometimes it means investors think estimates are wrong (too high in this case).

I think there are at least two things behind the increase in pessimism since July. First, investors are more concerned about U.S. economic growth. Consumer spending is seen to be at risk as we approach the resumption of student loan payments. The consumer names I follow closely have suffered more than the overall market. Secondly, bond yields have risen with the 30-year U.S. Treasury touching 5.0% recently. To put this move in context, two years ago the 30-year was at 2.0%. We need to rewind 16 years to find the last moment you could earn 5.0% with a U.S. treasury bond. Why does the yield on the U.S. treasury matter for stock prices? Among other factors, the U.S. Treasury bond is considered risk-free. As guaranteed yields rise, the incremental potential gains in (riskier) equities start to look less attractive, causing some investors to sell stocks. In other words, it has little to do with future earnings or cash flows from companies.

Would I swap bonds for stocks? My view is that interest rates and Treasury prices are hard to predict. The recent move to a 5.0% yield could easily reverse. I also don’t like the fact that inflation can offset potential returns on a fixed yield. I personally remain a lot more comfortable owning excellent companies that generate cash and can grow. If the stock prices go down in the short-term, so be it.

Recent China trip is a Reminder of the Distorting Power of Media Narrative*

Last month I spent a week in China, visiting Shanghai and Xi’an. The main reason for my trip was to attend the YUM China (YUMC) analyst day in Xi’an. YUM China is the master franchisee of YUM Brands, based in Louisville, KY and which owns Kentucky Fried Chicken, Pizza Hut and Taco Bell. YUMC operates these brands in China under a franchise arrangement with the U.S. parent. You may be surprised to learn that YUMC is the largest restaurant operator in China, and there are over 11,000 locations (mostly KFC) spread throughout China. Aside from this two-day event for analysts and investors, I also met with other local management teams and visited stores and restaurants on my own.

Personally, I find China fascinating. I won’t share all my observations in this letter but suffice it to say China is not like anywhere else I have visited. I should add that much of my interest is due to coming to the country with an investing perspective. If you’re looking for a tourist recommendation, I might point you elsewhere.

What did I see there? Certainly not the economic calamity that one might expect from the near-daily negative articles about China in the Wall Street Journal. The company management teams with whom I met also did not describe recessionary conditions. While my observations and work are limited to the consumer sector, my boots-on-the-ground research makes me highly suspicious of what I am reading in the Western press. To be honest, this méfiance should be applied to most media narratives, but especially when the topic is financial, political, medical, nutritional, meteorological, historical, cultural, geographical, gastronomical, astrological, or factual.

*There are many excellent journalists. My comments refer more to the media as a headline-generating, click-bait amalgam that haunts us on our phones and computers.

Selection From our Investment Portfolio: Planet Fitness. (PLNT)**

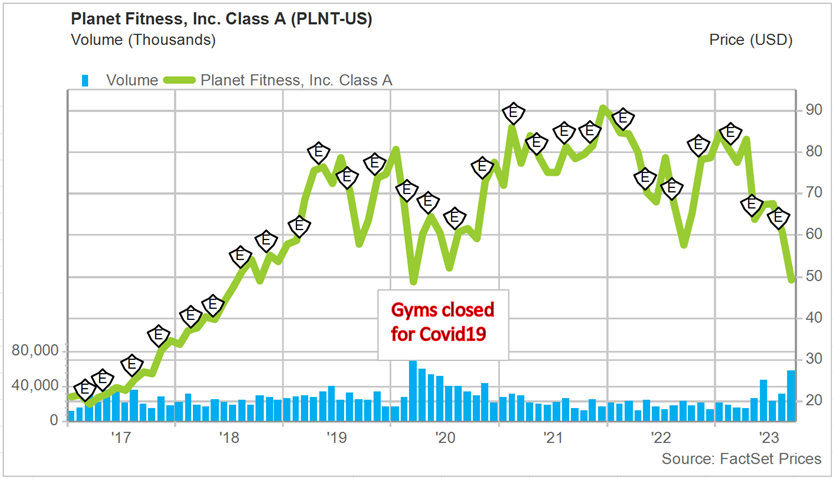

I originally got involved in shares of PLNT during the Covid-crisis. Planet Fitness is a franchisor and operator of low-cost gyms. The stock went public and started trading around $18 in mid-2015. It was an excellent performer, rising above $80 per share by the start of 2020. Then Covid came along, and you know what happened. Gyms were closed along with movie theaters, concert halls, restaurants and bingo parlors. Panicky investors who were worried about spending the rest of their days social distancing dropped PLNT shares about 50% over a four-week period. I won’t claim to have caught the bottom, but this is when I started looking at it. I had a very creative thesis: Eventually, gyms will reopen.

And it worked out great for about two years, with the shares trading into the low $90s by the end of 2021. This was followed by 2022, which was a tough year in general for stocks, and Planet Fitness was not immune. However, the company resumed opening new gyms and earnings continued to grow. I focused on this as a reason to stay invested. Fast forward to the current year. Investors began to become concerned that higher interest rates would make it more difficult for franchisees to obtain financing to open new gyms. The company slightly cut its growth rate. This was unfortunate, but didn’t change the long-term potential for the business, in my opinion. Subsequently, last month, the CEO abruptly quit or was fired (it’s not clear) with little explanation. Shares dropped 17% in a day in reaction to about $50 with a series of analyst downgrades following in subsequent days.

Which brings me to why I’m writing about it today. My approach is to favor owning excellent companies and to hold them over the long-term (indefinitely, if possible). I also want to buy these stocks when they are trading at a discount. In PLNT’s case, the shares can now be purchased at prices below when the gyms were closed during Covid. (See chart below.) I am apprehensive about the recent departure of the CEO, but can things really be worse than when the business was physically shuttered? Most of the business is operated by franchisee partners (from which the parent earns a fee) and most of the customers pay a low monthly subscription that is automatically charged to their credit cards. The predictable structure and high margins inherent to this model explains why the stock has traded at a relatively robust average P/E of 38x since going public. Today the shares are going for 20x, which is the lowest multiple it has ever seen. My guess is that EPS estimates are too high, but from this price I feel very good about the potential return. The harder you face-plant, the faster you bounce-back?

**This is not a recommendation to buy or sell any security. Please consult with your investment advisor for advice tailored to your investment objectives and risk tolerance.

Feedback and commentary welcome. Would you like to learn more about how we invest in the markets? Please click here to get in touch.

John Zolidis

President & Founder

Quo Vadis Capital, Inc.

John.zolidis@quovadiscapital.com

Mr. Zolidis founded Quo Vadis Capital, Inc., a Registered Investment Advisor (RIA) and research consultancy, in 2017. He started his career in finance in 1996 following degree studies in Philosophy at Kenyon College and the University of Oxford. He has followed U.S. consumer companies as a senior analyst since 1999, mostly on the sell-side, writing research for institutional investor clients. He also managed money in a buy-side role at a long-short equity fund over 2013-2014. He was named in the Wall Street Journal’s Best on the Street list in 2005. Mr. Zolidis and works from New York, NY and Paris, France or wherever he has his laptop.

Whereabouts and other activities: As mentioned above, in September, I traveled to China. Upon coming back from the Far East, I made a quick turnaround and flew to Cyprus. In Cyprus (another business trip, I promise) I presented an idea at the Cyprus Value Investor Conference. This time, I decided to do something a bit different and presented an idea in which I have a personal investment, Domino’s Pizza China (DPC-Dash), which trades on the Hong Kong exchange under the symbol (a number, I guess) 1405. I feel strongly about the company and recorded a 6 minute video of my presentation which you can watch on my YouTube channel. Please email me if you’d like a copy of the slides. (Please note this idea is not for everyone. This is not a solicitation and is not investing advice. Please consult your advisor!)

Later this month, I am returning to the U.S. I am starting in San Francisco, then flying to Minneapolis. I am catching a Green Bay Packers game at Lambeau Field before continuing to New York and Southampton. The purpose of my trip is mainly to meet with clients. However, I am also meeting with a few companies. I will guest lecture at Columbia Business School and will attend an analyst meeting with Starbucks in New York. If you are in any of these locations and would like to meet with me, please send me a message and we’ll try to schedule it! Thanks!

General Disclosures:

Quo Vadis Capital, Inc. (“Quo Vadis”) is an independent research provider offering research and consulting services. The research products are for institutional investors only. THIS IS NOT AN ADVERTISEMENT. Please consult your financial advisor for advice tailored to your financial and risk profile.

The author of this letter and accounts managed by Quo Vadis Capital have a long position in shares of Planet Fitness (PLNT) and DPC Dash (1405.HK).

The price target, if any, contained in this report represents the analyst’s application of a formula to certain metrics derived from actual and estimated future performance of the company. Analysts may use various formulas tailored to the facts and circumstances surrounding a specific company to arrive at the price target. Various risk factors may impede the company’s securities from achieving the analyst’s price target, such as an unfavorable macroeconomic environment, a failure of the company to perform as expected, the departure of key personnel or other events or circumstances that cannot be reasonably anticipated at the time the price target is calculated. Quo Vadis may change the price target on this company without notice. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources Quo Vadis believes to be reliable; however, Quo Vadis does not guarantee its accuracy and does not purport to be complete. Opinion is as of the date of the report unless labeled otherwise and is subject to change without notice. Updates may be provided based on developments and events and as otherwise appropriate. Updates may be restricted based on regulatory requirements or other considerations. Consequently, there should be no assumption that updates will be made. Quo Vadis disclaims any warranty of any kind, whether express or implied, as to any matter whatsoever relating to this research report and any analysis, discussion or trade ideas contained herein. This research report is provided on an “as is” basis for use at your own risk, and neither Quo Vadis nor its affiliates are liable for any damages or injury resulting from use of this information. This report should not be construed as advice designed to meet the particular investment needs of any investor or as an offer or solicitation to buy or sell the securities or financial instruments mentioned herein. This report is provided for information purposes only and does not represent an offer or solicitation in any jurisdiction where such offer would be prohibited. Commentary regarding the future direction of financial markets is illustrative and is not intended to predict actual results, which may differ substantially from the opinions expressed herein. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. The author of this write up does not have any positions in securities mentioned.

Permission is hereby granted to reproduce or redistribute this report. Please cite Quo Vadis Capital, Inc. in any reproduction.

SEC Reg AC Certification: All of the views expressed in this research report accurately reflect the research analyst’s personal views about any and all of the subject securities or issuers. No part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in the subject company of this research report.